Policy Agenda

The Storm is Already Here: 2026 Policy Agenda

As financial hardship rises across Connecticut and instability from Washington spreads, the storm is hitting ALICE families first and hardest. They’re feeling the squeeze of rising costs, stagnant wages and a cooling economy, without the protection they need to weather it. And without strong support, they risk falling even further behind.

Connecticut United Ways are committed to building a brighter future with and for ALICE families. During the 2026 legislative session, we will work tirelessly alongside community partners to:

Establish a Fully Refundable Connecticut Child Tax Credit

- Returning money to families enables them to buy essential items for their children that other programs don’t cover.

- A fully refundable CT Child Tax Credit of $600 per child benefits 550,000 children and 75% of families. (Eligibility: up to $100,000 annual income for a single filer, $200,000 for joint filers)

- A 100% refundable credit means that families who do not have a tax liability would receive the full value of the credit.

- Families spend these tax credits right away, boosting local businesses and the state economy.

- Estimated cost of the child tax credit for up to three children: $300 million per year. (Exact family benefits and total policy cost depends on income phaseout schedule)

Impact of CT Child Tax Credit

Research and Resources

- Parents Under Pressure: The U.S. Surgeon General Advisory on the Mental Health and Well-Being of Parents

- Opportunity Connecticut: Reimagining Our Workforce, Economy, and Quality of Life (Connecticut Business and Industry Association)

- Young People First (Connecticut Conference of Municipalities)

- Poverty in the U.S. and Connecticut, 2019-2023 (CT Voices for Children)

- The Role of a Connecticut Child Tax Credit (CT CTC) in Eradicating Poverty and Advancing Racial and Ethnic Equity (CT Voices for Children)

- A Connecticut Child Tax Credit (CT CTC) in Making Our Tax System Fairer and Stimulating Economic Growth (CT Voices for Children

- The proposed Connecticut Child Tax Credit: Estimating impacts for towns, legislative districts, and households by race and ethnicity (DataHaven)

Supported by the CT Child Tax Credit Coalition

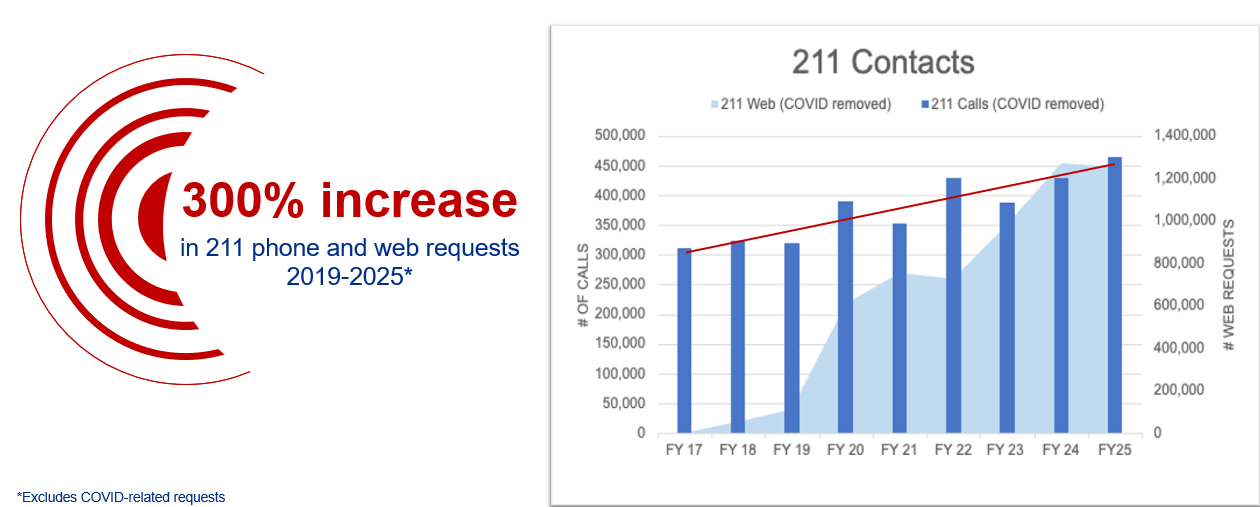

Invest in 211 to Meet Increasing Demand

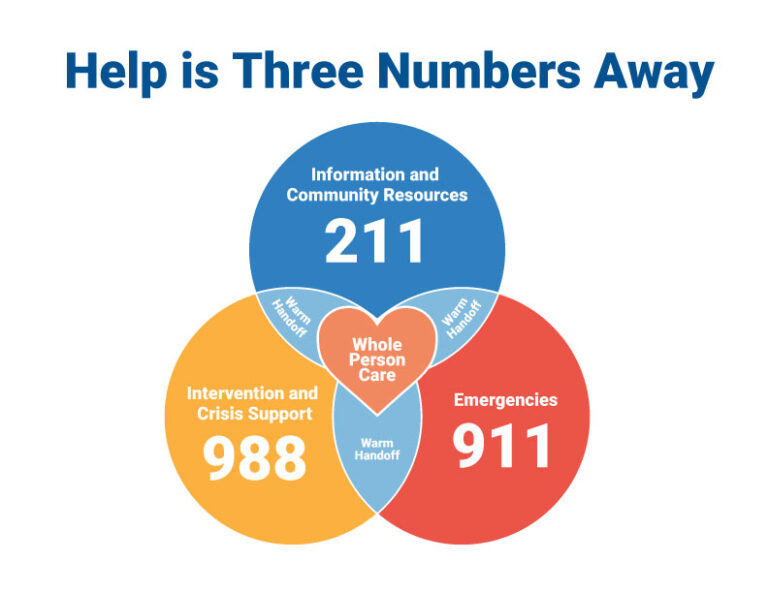

Since its inception in 1976 as a public-private partnership with the State of Connecticut, 211 has connected countless residents with essential services, from housing assistance to mental health support. When you call 211, a professional contact center specialist will listen to your needs and connect you with a wide range of resources and benefits that meet them.

This is more than simply “patching people through” to agencies. It’s about providing comprehensive care and efficient support for your unique situation. Our trusted database of 40,000 essential services provides a “one-stop shop” for residents and gives hardworking families the support they need to contribute to their communities and thrive.

2026 Legislative Session Update

In response to rapidly rising demand, the state approved an additional $2.6 million investment to support 211’s core Information & Referral services, allowing the hiring of 11 additional frontline staff. This will help reduce wait times and help more residents get connected to help when they need it most.

Impact of 211

Top Service Requests in 2025 Across Connecticut*

Housing & Shelter | 620,348 |

Mental Health & Addictions | 207,730 |

Food | 179,872 |

Employment & Income | 122,471 |

Healthcare & COVID-19 | 77,750 |

Utilities | 74,901 |

Government & Legal | 53,601 |

Clothing & Household | 44,255 |

Transportation Assistance | 31,624 |

Disaster | 19,734 |

Child Care & Parenting | 19,118 |

Education | 9,707 |

Other | 262,756 |

*Calls and web requests

Partnerships

United Way of Connecticut is an active member of statewide advocacy partnerships committed to helping ALICE families thrive and advancing policies that expand opportunity across our state.

Bill Tracker

Need help? Have an idea?

Our advocacy team is here for you.

Daniel Fitzmaurice, Director of Advocacy

Daniel.Fitzmaurice@CTUnitedWay.org

860-249-8788

Cheryl Hardgrave, Advocacy Coordinator

Cheryl.Hardgrave@CTUnitedWay.org

860-372-4216